Please update your browser.

The financial resilience of families is a critical factor in the overall health of the US economy. Americans across the income spectrum experience high levels of income and spending volatility, and health emergencies are among the most common economic hardships. One in six families makes an extraordinary medical payment in any given year. Families’ financial outcomes worsen as a result of the extraordinary medical payment and do not fully recover even a year after. This is especially true for women. The gender gap in financial outcomes widens after an extraordinary medical payment.

The JPMorgan Chase Institute compares the financial outcomes of accounts held by women versus men and examines changes in these outcomes that result from an extraordinary medical payment. The Institute assembled a de-identified sample of more than 210,000 core Chase checking account customers between 2013 and 2015, for whom we could infer the gender of the primary account holder and categorize at least 80 percent of expenses.

Our findings are five-fold:

Finding 1: While most primary account holders were men (54 percent), low-income primary account holders were more likely to be women.

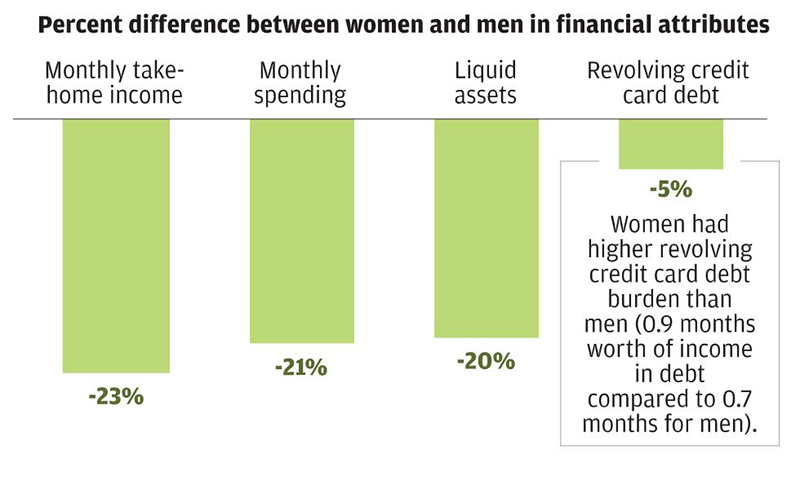

Finding 2: There was a gender gap in financial outcomes—women exhibited roughly 20 percent lower levels of income, spending, and liquid assets, and slightly higher credit card debt burden than men.

Finding 3: Extraordinary medical payments represented a higher fraction of monthly take-home income for women than for men. Women were in a weaker financial position than men to withstand an extraordinary medical payment.

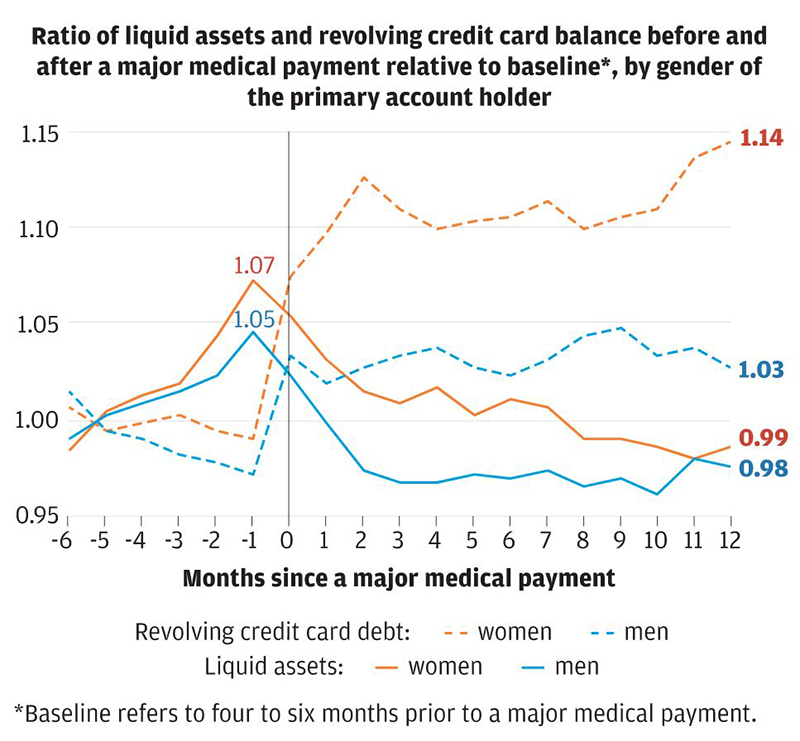

Finding 4: Immediately before making an extraordinary medical payment, women exhibited a larger increase in liquid assets relative to men, suggesting that they were more likely than men to delay a medical payment until they were able to pay.

Finding 5: A year after the extraordinary medical payment, the gender gap in financial outcomes had worsened, leaving women with significantly more revolving credit card debt than men.

This brief underscores the importance of efforts to address the gender gap in financial outcomes and reduce debt burdens for women. In addition, should out-of-pocket healthcare costs increase due to changing tax credits or the elimination of essential benefits, women may have to shoulder more of the economic burden of receiving care. As documented here, extraordinary medical payments have negative impacts on financial outcomes, and this is especially true for women.