Please update your browser.

History of Our Firm

JPMorgan Chase & Co. is one of the world's oldest, largest and best-known financial institutions.

The firm is built on the foundation of more than 1,200 predecessor institutions that have come together through the years to form today's company.

We trace our roots to 1799 in New York City, and our many well-known heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First National Bank of Chicago, National Bank of Detroit, The Bear Stearns Companies Inc., Robert Fleming Holdings, Cazenove Group and the business acquired in the Washington Mutual transaction. Each of these firms, in its time, was closely tied to innovations in finance and the growth of the U.S. and global economies.

Explore the timeline below and visit our video library to learn more about the firm’s history.

Explore Our History

Click on a time period to learn more

1799-1850s

1860s-1910s

1915-1940s

1950s-1970s

1980s-1990s

2000s-Present

The Early Years of State Banking

1799

The Manhattan Company is founded

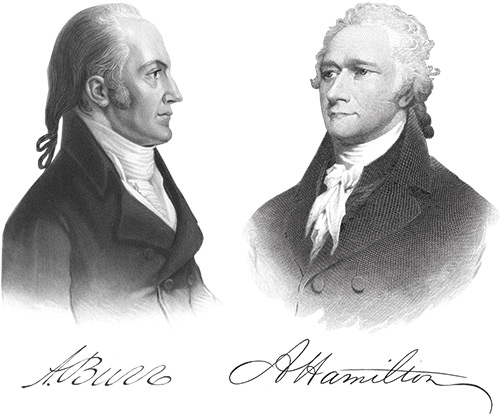

The Manhattan Company, JPMorgan Chase's earliest predecessor institution, is chartered by the New York State legislature to supply "pure and wholesome" drinking water to the city's growing population. Among its founders are Alexander Hamilton and Aaron Burr.

A provision in the charter allows The Manhattan Company to use its surplus capital for banking operations. Within five months, The Bank of The Manhattan Company opens for business, becoming the second commercial bank in New York City after Hamilton’s Bank of New York. With his banking monopoly broken, Hamilton severs his association with the water company.

1804

The Hamilton – Burr duel

Manhattan Company founder Aaron Burr challenges his personal and political adversary, Alexander Hamilton, to a duel. The two men meet at dawn on July 11th in Weehawken, New Jersey, across the Hudson River from New York City. Hamilton is mortally wounded and dies the next morning.

The pistols selected by Hamilton for the duel were owned by his brother-in-law, John B. Church. In 1930 The Bank of The Manhattan Company purchases them from one of Church's descendants.

1807

First philanthropic endeavor

The Manhattan Company grants New York City’s volunteer fire companies free access to its network of water pipes to fight fires, contributing to the community’s public safety.

1812

The New York Manufacturing Company is incorporated

The New York Manufacturing Company, the earliest predecessor in Manufacturers Hanover’s family tree, is created to produce tools and parts for the textile industry. The company’s charter permits it to conduct a banking operation, similar to The Manhattan Company's example, and it establishes Phenix Bank in 1817.

1817

The Bank of The Manhattan Company funds the Erie Canal

The Bank of The Manhattan Company is a key lender for the construction of the Erie Canal, which opens in 1825 linking the Hudson River to the Great Lakes. Later in the century the bank provides funds to support interest payments on Erie Canal bonds and to enlarge and modernize the canal.

1823

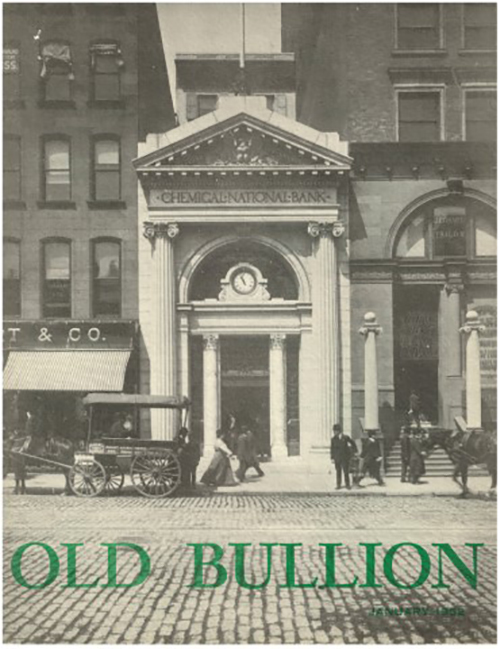

The New York Chemical Manufacturing Company opens

New York City merchants organize the New York Chemical Manufacturing Company to produce chemicals, medicines, paints and dyes. The company's charter prohibits banking activities but a year later the company secures an amendment enabling it to establish a banking subsidiary called The Chemical Bank.

1839

Bank of Commerce opens

The Bank of Commerce opens in New York City. This institution, which merges with the Guaranty Trust Company of New York in 1929, is the earliest predecessor on the J.P. Morgan family tree.

1853

The New York Clearing House brings efficiency to banking

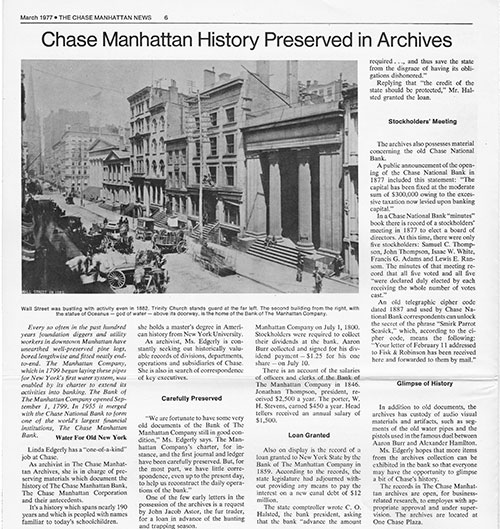

The New York Clearing House is organized, with several JPMC predecessors as charter members, to systematize the daily settling of checks drawn on other local banks. Previously, messengers went from bank to bank to trade checks for cash, a time-consuming and risky process. Centralized clearing greatly reduces the number of transactions and risk among member banks. More than $20 million is cleared on its first day of operation.

1853

Abraham Lincoln becomes a customer

Springfield Marine and Fire Insurance Company opens in 1851 to insure shipping vessels and goods, but it also provides a variety of banking services. Illinois lawyer Abraham Lincoln opens a bank account there two years later with an initial deposit of $310. Lincoln keeps his account in Springfield through his presidential years until his assassination. The firm later evolves into Marine Corporation, a Bank One predecessor.

1854

Junius Morgan begins business in London

Junius S. Morgan, patriarch of the Morgan banking family, moves to London and joins the private banking firm George Peabody & Co. It becomes the leading marketer of American securities in England and Europe, raising capital for the first transatlantic telegraph cable in 1858 among other important deals. The firm is restyled J. S. Morgan & Co. in 1864 and continues as a critical connection in the J.P. Morgan international banking network through the end of the century.

1857

The Panic of 1857

A financial panic causes 18 New York City banks to close on a single day and ushers in a severe economic depression. Most banks suspend “specie payments” but Chemical Bank continues to redeem banknotes in gold coin, helping to stabilize the financial markets and earning it the nickname “Old Bullion.”

National Banks and the Age of Industry

1862-1864

The Legal Tender Act and National Banking Acts

New banking laws passed during the Civil War authorize the U.S. government to create a uniform national currency, ease borrowing to pay its war expenses, and set up a new system of nationally chartered banks.

The Legal Tender Act of 1862 provides for a standard national currency, nicknamed "greenbacks" for the elaborate design printed on the back of the notes. Because the notes are unsecured by gold deposits, the value of greenbacks fluctuates widely.

The National Bank Act of 1863 creates a new system of national banks operating under a uniform regulatory framework alongside the older state-chartered banks. The act empowers national banks to issue money in amounts secured by U.S. government bonds purchased and held in reserve by the banks. The 1863 law is strengthened by a second National Bank Act passed the following year.

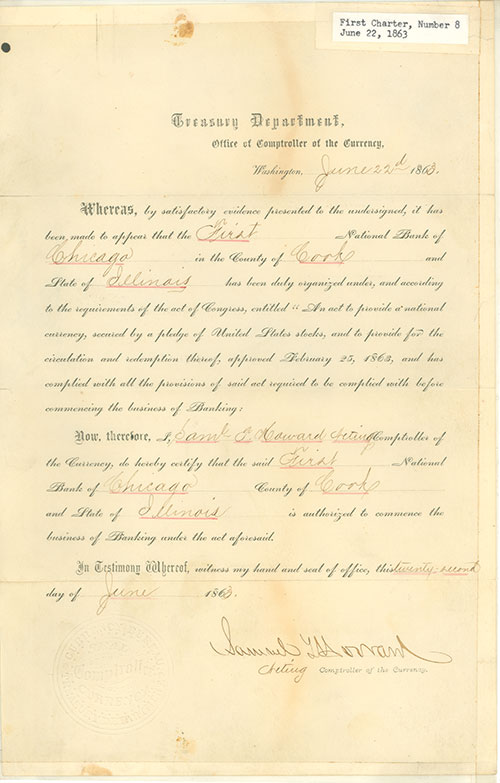

1863

First National Bank of Chicago, eighth in the nation

The First National Bank of Chicago opens for business, becoming the eighth nationally chartered bank under the new National Banking Act. JPMorgan Chase Bank continues to operate under this charter #8 to this day.

1863

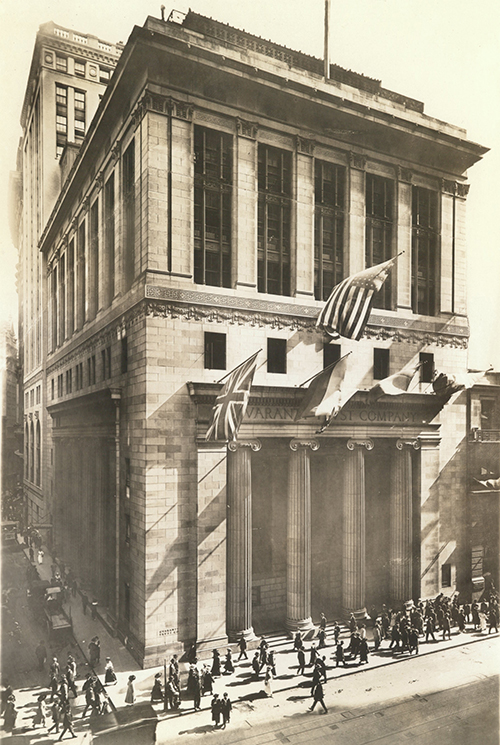

Guaranty Trust Company’s origins

The New York Guaranty and Indemnity Company is founded in New York. This institution, which evolves into Guaranty Trust Company of New York, later merges with J.P. Morgan & Co. in 1959.

1868

Origins of Bank One

F.C. Sessions and Company is founded in Columbus, Ohio. This is Bank One's earliest predecessor in Columbus, its hometown base.

1868

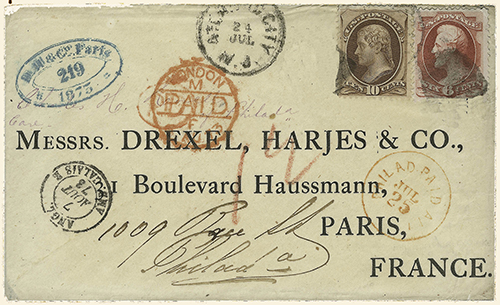

Drexel, Harjes & Co. opens in Paris

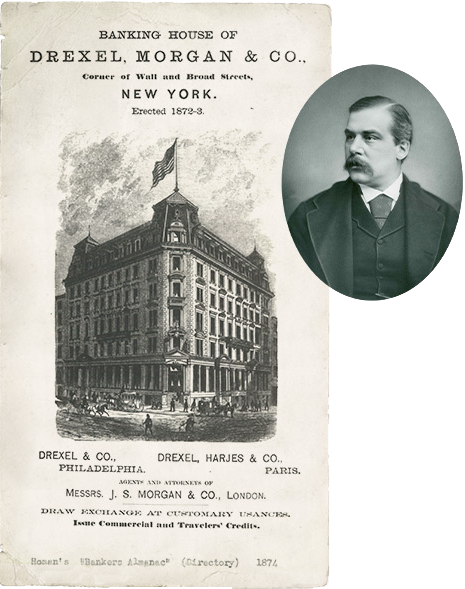

In 1868, Anthony Drexel establishes Drexel, Harjes & Co. in Paris, JPMorgan Chase’s earliest predecessor in France. Three years later, J. Pierpont Morgan partners with Drexel to open Drexel, Morgan & Co. in New York, later renamed J.P. Morgan & Co.

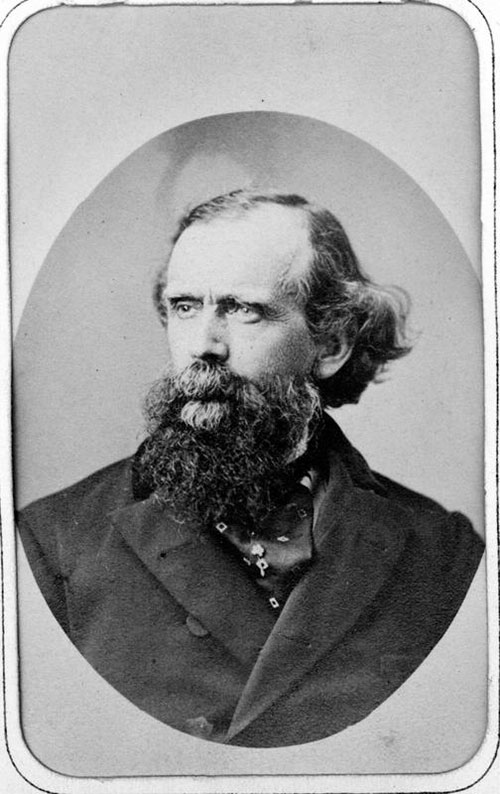

1871

Drexel, Morgan & Co. is founded

J. Pierpont Morgan partners with Philadelphia banker Anthony Drexel to form Drexel, Morgan & Co., a private merchant banking house in New York City. Pierpont builds his reputation as a leader in railroad investments, the largest and most dynamic American industry in the years after the Civil War. The firm is rechristened J.P. Morgan & Co. in 1895 with Pierpont as the head of all four affiliated partnerships in New York, Philadelphia, London and Paris.

1871

Fire devastates Chicago

When the Great Fire sweeps through Chicago in 1871, the First National Bank of Chicago's new "fireproof" building at the corner of State and Washington Streets is almost completely destroyed. The safes and vaults withstand the flames, however, leaving money, securities and valuable papers intact.

1877

Chase Bank begins business

Chase National Bank is founded by John Thompson, a noted New York City banker and financial publisher. Thompson names the new bank in honor of his friend, Salmon P. Chase, Secretary of the Treasury under Abraham Lincoln and architect of the National Banking System.

1879

J.P. Morgan and railroad finance

Drexel, Morgan & Co. sells William H. Vanderbilt's shares of New York Central Railroad stock. At 250,000 shares it is, at the time, the largest block of stock ever publicly offered. The deal establishes J. Pierpont Morgan’s reputation as an expert railroad financier and mobilizer of capital. The next year, Morgan finances the completion of the Northern Pacific Railroad underwriting the sale of $40 million in bonds, at the time "the largest transaction in railroad bonds ever made in the United States."

Through the end of the century, Morgan wields enormous power in the American railroad industry, reorganizing failing lines, orchestrating mergers, restructuring debt, eliminating competition and cutting costs to return the companies to profitability – a process dubbed “Morganization” by the press.

1882

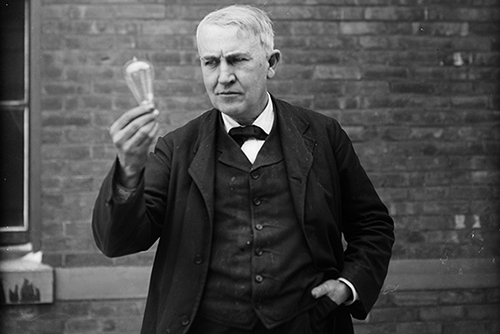

Investing in electricity

The Drexel, Morgan & Co. building at 23 Wall Street is the first office building in New York City to draw power from the Edison Electric Illuminating Company's newly built electric generating station. Thomas Edison personally turns on the building's lights.

1882

First Chicago caters to women customers

First National Bank of Chicago establishes a women's banking department, one of the first in the United States to provide specifically designed accommodations for women customers. Over the next several decades, other banks provide distinct sections with separate entrances, writing desks and lounges to provide greater comfort to female clients.

1883

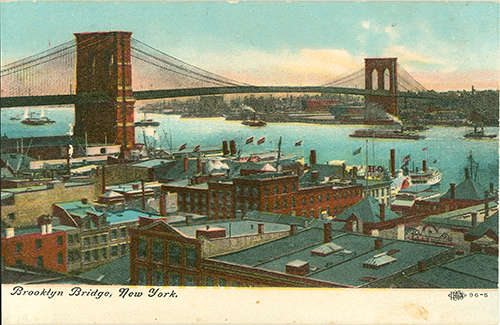

The Brooklyn Bridge opens

The Brooklyn Trust Company, a Manufacturers Hanover predecessor, is responsible for most of the nearly $15 million needed to finance the bridge’s construction. It is the longest suspension bridge in the world at that time.

1886

The Statue of Liberty is dedicated in New York Harbor

William L. Strong, founder of one of Chemical Bank's forerunners, is active in the fundraising campaign for the construction of the pedestal for the mammoth statue, a gift from France. Another Chemical Bank predecessor, Liberty National Bank (founded in 1891), later uses the statue as its logo.

1889

The Great Seattle Fire and founding of Washington Mutual

Washington National Building Loan and Investment Association is founded after a fire destroys much of Seattle's core. The following year it makes the first monthly installment home loan on the Pacific Coast, lending $700 to a customer to build a house. The firm makes 2,000 similar loans, helping to rebuild 250 blocks of housing in the city.

1892

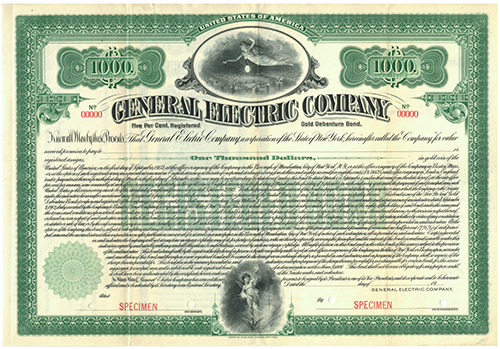

General Electric Company is organized

Drexel, Morgan & Co. finances the consolidation of Thomas Edison’s electric companies with the Thomson-Houston Electric Company to form General Electric Company, one of the most important industrial combinations of the late 19th century.

1895

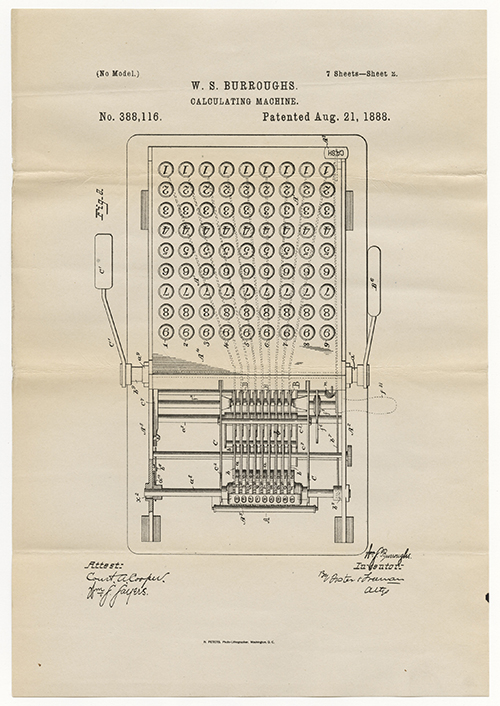

A technological innovation

First National Bank of Chicago is the first Chicago bank to acquire the newly invented Burroughs Registering Accountant – an adding machine. Manufactured by the American Arithmometer Company, later renamed Burroughs Adding Machine Co., the crank-operated machines printed entries and totals on a paper tape.

1895

Morgan shores up the U.S. Treasury gold reserves

In the years following the Panic of 1893, gold drains from the United States Treasury, causing a crisis in the nation’s currency, banking and international trade. J. Pierpont Morgan organizes a private sale of government bonds to European buyers to replenish the nation’s gold supply and restore public confidence, setting the stage for an economic recovery.

1901

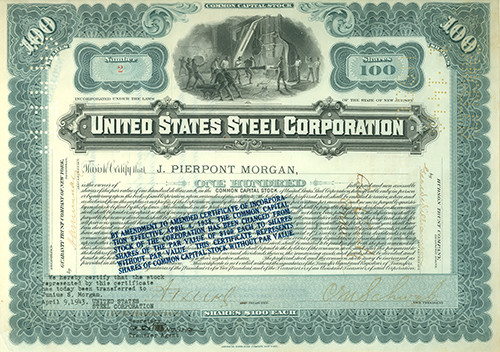

United States Steel is organized

J.P. Morgan & Co. organizes the buyout of industrialist Andrew Carnegie and combines some 15 companies to create United States Steel, the world's first billion-dollar corporation.

1904

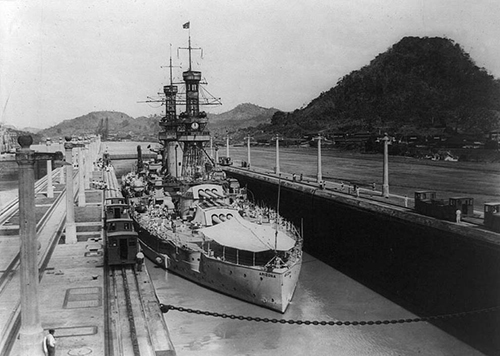

Morgan finances the Panama Canal

J. P. Morgan & Co. helps finance the Panama Canal, arranging for the transfer of $40 million for the U.S. government to buy land rights from the failed French endeavor that had begun construction of the canal in 1881. The purchase is the largest real estate transaction in history up to that time.

1907

The Panic of 1907

J. Pierpont Morgan again takes charge during an economic crisis. As the stock market collapses, credit dries up, and banks and brokerages fail, Morgan marshals the major New York banks to supply liquidity to desperate markets, including purchasing $30 million of New York City bonds to avoid the city’s default. For two weeks, Morgan holds the group together until public confidence in the banks is restored. The crisis points to the need for a central bank and leads to the creation of the Federal Reserve System in 1913.

1911

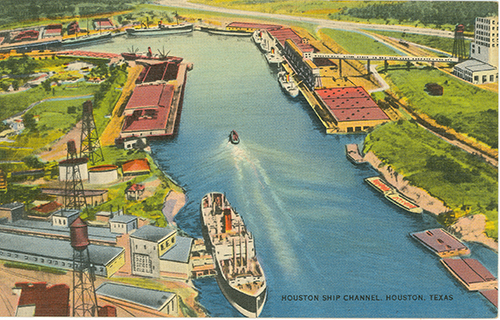

Financing the Houston Ship Channel

The 50-mile channel, linking land-locked Houston, Texas with Galveston Bay, is financed by bonds purchased by Texas Commerce predecessor, Union National Bank, and other local banks. Houston developer and banker Jesse H. Jones plays a significant role in marketing the bond issue. Completed in 1914, the channel is today one of the busiest waterways in the United States.

1913

J. Pierpont Morgan dies

J. Pierpont Morgan dies while traveling in Rome on March 31, 1913. His son, J.P. (Jack) Morgan, Jr. becomes J.P. Morgan & Co.'s senior partner. The New York Stock Exchange closes until noon on the day of his funeral, an honor generally reserved for heads of state.

1914

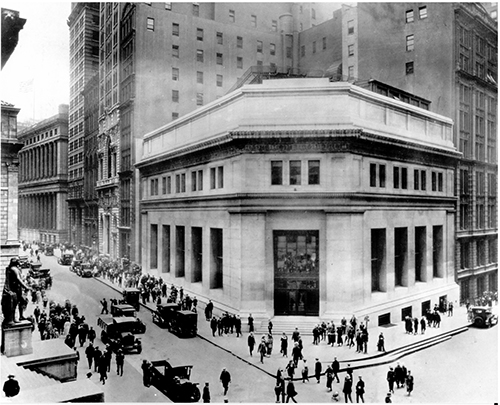

A new Morgan home rises on Wall Street

Construction begins in 1912 on a new J.P. Morgan & Co. headquarters at the firm’s historic site at 23 Wall Street. Completed the year after J. Pierpont Morgan’s death, the four-story neoclassical-style building embodies the firm’s characteristically discreet business style. The Morgan name is deliberately left off the building’s façade; the entrance doors bear only the street address “23.”

World Wars, Depression and International Expansion

1915

Support for the Allies

During World War I, J.P. Morgan & Co. arranges the largest foreign loan in Wall Street history – a $500 million bond issue to support the English and French governments – and acts as purchasing agent for the Allies, facilitating the purchase of over $3 billion worth of war material and other goods needed by the Allies.

Other JPMC predecessor banks support the war effort by providing critical banking services in war-torn Europe. After America’s entry into the conflict, banks sell war bonds and many of their employees serve in the armed forces or volunteer with the Red Cross.

1920

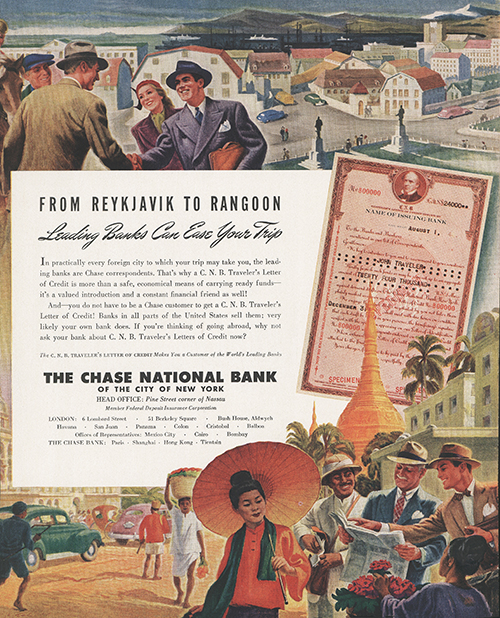

Post-war international expansion

After the war banks diversify and expand into new global markets. Chase National Bank and Guaranty Trust Company set up affiliates to do securities underwriting and open new branches in Europe, Asia and Latin America. Chase National merges with Equitable Trust Company in 1930, combining their extensive overseas branch networks and making Chase the world’s largest bank.

1923

Washington Mutual School Savings Program

Washington Mutual Savings Bank launches the School Savings Program, one of the first to teach children the value of saving money. On the first School Bank Day nearly 17,000 schoolchildren make deposits. The program runs until the 1970s, introducing several hundred thousand children to banking.

1924

Japan earthquake loan

Following the 1923 Great Kantō earthquake that devastated Tokyo and the city of Yokohama, J.P. Morgan & Co. leads a $150 million loan, part of an ambitious reconstruction plan. It is the first dollar loan to Japan and, at the time, the largest long term foreign loan ever placed in the American market. Three years later, Jack Morgan is decorated with a medal by the emperor of Japan for the firm’s financial help following the earthquake.

1924

Pioneering women in banking

Chase National Bank hires Mary Vail Andress as an assistant cashier. She becomes the first female officer at a major New York City bank’s main office. Although women first entered the banking profession through clerical positions in the late nineteenth century, a number of pioneering women like Andress paved the way for others to achieve a range of positions within the financial sector.

1927

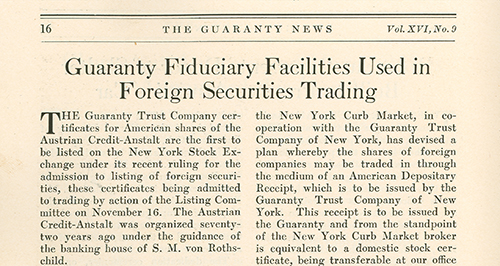

Guaranty Trust Company invents the ADR

American Depositary Receipts (ADRs) represent shares of stock in a foreign company and trade on U.S. stock markets in dollars, simplifying investing in non-U.S. securities and opening access to American capital. In 1927 Guaranty Trust offers the first ADR for sale for U.K. retailer Selfridges Stores.

1929

The 1929 stock market crash and its impact on banking

On October 29, 1929, after a decade of speculation and rising prices, the stock market collapses ushering in the Great Depression. The effect on the banking system is devastating as credit tightens and lenders call in margin loans that were used to speculate in the market. Depositors, worried that their bank might fail, rush to withdraw their savings. Over the next three years, such bank runs become more and more common. Unable to raise new funds from the Federal Reserve System, hundreds of banks fail throughout the nation.

1931

Houston banks rescued

Jesse H. Jones, president of Houston’s National Bank of Commerce, organizes a group of top bankers and corporate leaders to bail out two failing Houston banks, Public National and Houston National, forestalling the collapse of the city's more stable banking institutions. Due to Jones’ leadership, no Houston banks fail during the Depression.

1933

National Bank of Detroit opens

The National Bank of Detroit, forerunner of NBD Bancorp, opens in Detroit amidst a nationwide financial collapse. As depositors lose confidence in banks’ solvency, the federal government declares a bank holiday – closing all banks to give the financial system time to stabilize. After Detroit’s two major banks fail, Michigan is virtually without banking services for six weeks. The Reconstruction Finance Corporation and General Motors capitalize a new National Bank of Detroit, which opens 562 new accounts on its first day in business.

1940

J.P. Morgan goes public

J.P. Morgan & Co., a private partnership since its inception, incorporates and sells shares to the public, becoming J.P. Morgan & Co. Incorporated. J.P. (Jack) Morgan, Jr., the firm's senior partner, becomes the new corporation's first chairman.

1941

Our first drive-in

National Bank of Detroit is the first JPMC heritage bank to open a drive-in banking window. The idea was pioneered by a Vernon, California bank in 1937, but does not become a widespread service for retail consumers until the late 1940s.

1941-1945

Service during World War II

Following the bombing of Pearl Harbor and America's entry in the war, our predecessor banks support the war effort abroad and at home. Thousands of bank employees serve overseas in the military, while at-home employees participate in blood drives and prepare packages of food, clothing and supplies for troops stationed abroad. Our predecessors play an important role in buying and promoting Treasury securities, sponsoring drives and selling war bonds at branches.

1947

Post-war expansion

Chase National Bank establishes a branch in Japan and the first post-war U.S. bank branch in Germany.

A new wave of post-war expansion engulfs the global economy in the years following the end of World War II. By establishing new branches, representative offices and correspondent bank relationships abroad, our predecessors begin providing a wide range of international customer services, such as travelers’ checks. Corporate clients can now more easily obtain trade financing, bills of exchange and commercial letters of credit.

Bank Consolidation and Innovation

1950s-1960s

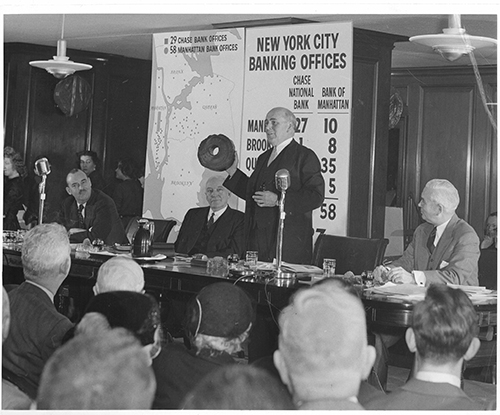

Bank consolidation in New York City

Post-war banking in America is marked by two trends: consolidation of banks through mergers and the growth of branch banking, reversing the pattern of small, single-office banking that had existed for more than a century. Branch banking had been viewed as monopolistic, but by the 1950s, the public wanted more convenient, local banking and a broader choice of services that could be provided by larger banks. All four of JPMorgan Chase’s New York City heritage firms – Chemical Bank, Chase Manhattan Bank, Morgan Guaranty Trust and Manufacturers Hanover Trust – are formed in this period of consolidation.

1955

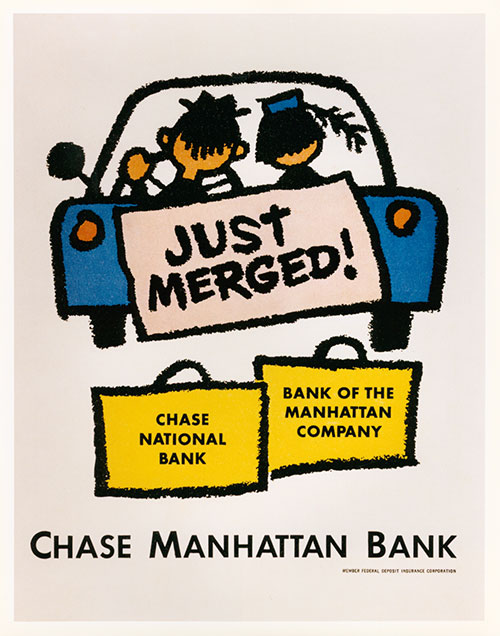

Chase Manhattan Bank is created

Chase National Bank merges with The Bank of The Manhattan Company to form Chase Manhattan Bank. The new institution combines Chase National’s strength in international, corporate, and correspondent banking with The Bank of The Manhattan Company's network of branches and retail banking expertise.

1958

Chase launches the first credit card in New York

Chase Manhattan introduces the Chase Manhattan Charge Plan, the first New York City bank to offer a retail credit account. The card is soon renamed Uni-Card and in 1972 joins the national BankAmericard System, the precursor to Visa.

1959

Morgan Guaranty is organized

J.P. Morgan & Co. Incorporated merges with Guaranty Trust Company of New York forming Morgan Guaranty Trust Company of New York.

After rebuffing merger overtures from Guaranty Trust Company, then four times the size of Morgan with almost all of America's top 100 companies as clients, having watched its competitors grow rapidly through mergers, which diminished its own assets by comparison, Morgan agrees to merge but with the name Morgan Guaranty Trust Company. The combination creates one of the world’s largest trust operations.

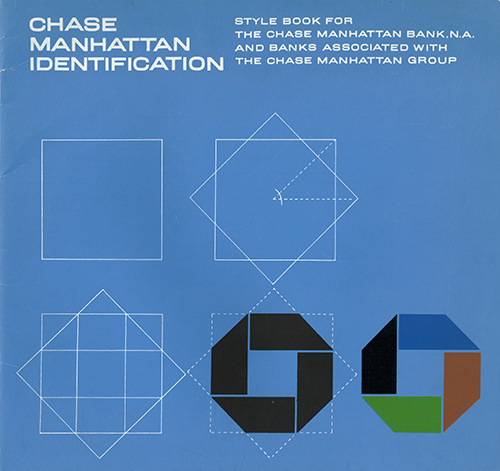

1960

Chase Manhattan introduces the Octagon logo

The design firm Chermayeff & Geismar is selected to design a new logo to reflect Chase Manhattan Bank’s increasing global presence. The new octagon symbol is intended to be a simple yet powerful form, embodying a feeling of motion centered around a square. The Octagon is one of the earliest abstract corporate logos and continues to be a significant element in the JPMorgan Chase brand architecture.

1960

You Have a Friend at Chase

Around the same time it unveils its octagon logo, Chase also unveils a new advertising campaign. The “You Have a Friend at Chase” campaign runs from January 1960 through 1975 and becomes one of the first to feature the bank’s new logo. Coining one of Chase’s most memorable slogans, the advertisements reinforce the notion of friendly service no matter which Chase branch you visit, domestic or international.

1961

Electronic data processing comes to banking

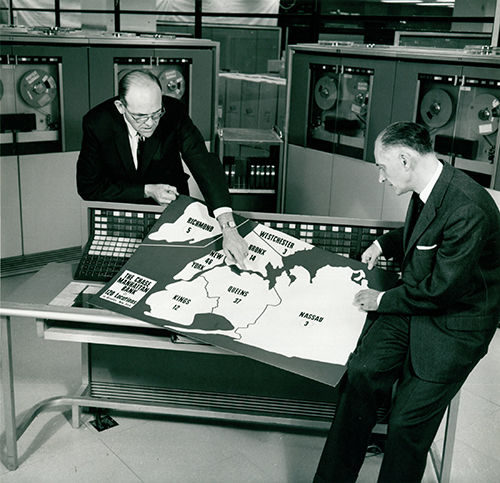

Chase Manhattan, First National Bank of Chicago and National Bank of Detroit each install computer equipment for the electronic processing of checks. Only two years after Chase Manhattan Bank installs one of the first computers in New York, an IBM 650 Data Processing System, the bank builds an automated check-processing center. Using new technology to read magnetic ink characters printed on checks, the system processes more than a million checks a day in its first year.

1961

Manufacturers Hanover gets its start

Manufacturers Trust Company and The Hanover Bank merge, forming Manufacturers Hanover Trust Company, then the third largest banking institution in New York City.

1966

Credit cards go national

City National Bank & Trust Company in Columbus, Ohio, (Bank One’s main predecessor) establishes a national credit card program, becoming the first bank outside of California to introduce the BankAmericard, the precursor to Visa. In 1969, Manufacturers Hanover and Chemical Bank are among the founding issuers of the Master Charge Plan, today’s Master Card.

1968

Euroclear is founded

Morgan Guaranty in Brussels launches Euroclear, a system that provides for the orderly settlement of transactions in Eurobonds, a new form of international security. Ownership is spun-off to its users in 1972 and in 2000 Euroclear Bank is launched to perform the operating and banking roles previously carried out by Morgan Guaranty.

1969

The ATM era begins

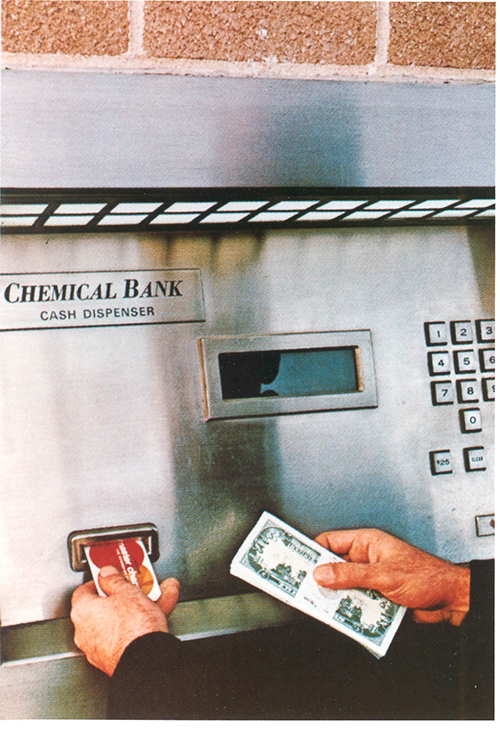

Chemical Bank installs the nation’s first cash dispensing machine – the precursor to the ATM – in a Rockville Center branch on Long Island, inaugurating 24-hour banking in the New York metropolitan area. In 1970 Bank One forerunner City National Bank installs ATMs in its branches, making Columbus, Ohio, a major test market for the machines. Technological improvements to the ATM and added functionality, such as making deposits and transfers, are rolled out beginning in 1971.

1969

Bank holding companies set the stage for growth

Morgan Guaranty, Chase Manhattan, Manufacturers Hanover, Chemical, and First National Bank of Chicago all reorganize to form holding companies, corporate entities that own the capital stock of their lead banks. Holding companies permit greater flexibility to raise capital and expand geographically and functionally. The Marine Corporation in Wisconsin, a Bank One predecessor, is the first bank holding company in the U.S., founded in 1958.

1973

Opening doors to Russia and China

Chase Manhattan establishes a representative office in Moscow, the first U.S. bank to have a business presence there since the 1920s. Connections with mainland China are reinvigorated the same year when Chase Manhattan becomes the first American correspondent of the Bank of China since the 1949 revolution.

1974

Rockefeller establishes the Chase Manhattan Bank Archives

In 1974, David Rockefeller, chairman of Chase Manhattan Bank, establishes the Chase Manhattan Bank Archives in an effort to preserve the legacy of his firm. With each successive merger, the archive continues to grow, adding to its collection the documents and artifacts of the newly-merged banks. Today, the JPMorgan Chase Historical Collection is one of the largest private business collections in the country and documents the heritage of the firm’s over 1,200 predecessor institutions.

1978

A gift to the Smithsonian

Chase Manhattan Bank donates the Money Museum, the bank's famed collection of money from around the world, to the Smithsonian Institution. The collection contains 75,000 specimens of coins, paper currency and transactional objects from all time periods since the introduction of monetary systems. The gift to the Smithsonian’s national numismatic collection is intended to make these objects more accessible to the public.

Interstate Banking Meets the Computer Age

1980

At home banking develops

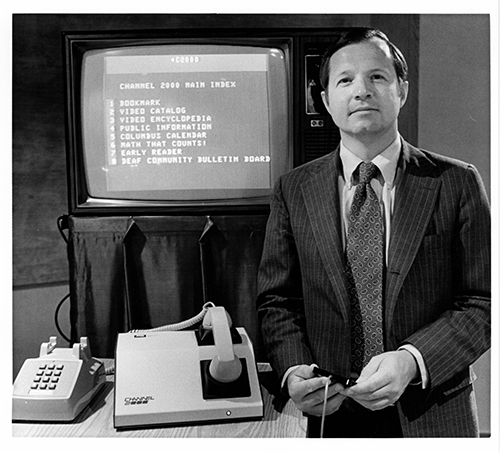

Bank One tests an early version of home banking called Channel 2000. Bank customers can view their bank balances on a television screen, pay bills and shift money between accounts. The service works over regular telephone lines. In 1983 Chemical Bank introduces Pronto, the first full-fledged online banking service, and in 1985 Chase Manhattan Bank introduces Spectrum, a home banking service offering three tiers of service: core banking, financial planning, and investing.

1985

Expanding beyond markets: the age of interstate banking

The Supreme Court rules that regional interstate banking zones are constitutional, marking an important step toward the development of full interstate banking today. Up to this time, bank holding companies were prohibited from acquiring banks across state lines. As a result, our New York heritage firms begin expanding beyond the New York City market, while all three Midwest heritage firms – Banc One in Ohio, First Chicago in Illinois, and NBD in Michigan – merge with large bank holding companies in other states before merging with one another in the 1990s.

1985

Networked ATMs is NYCE

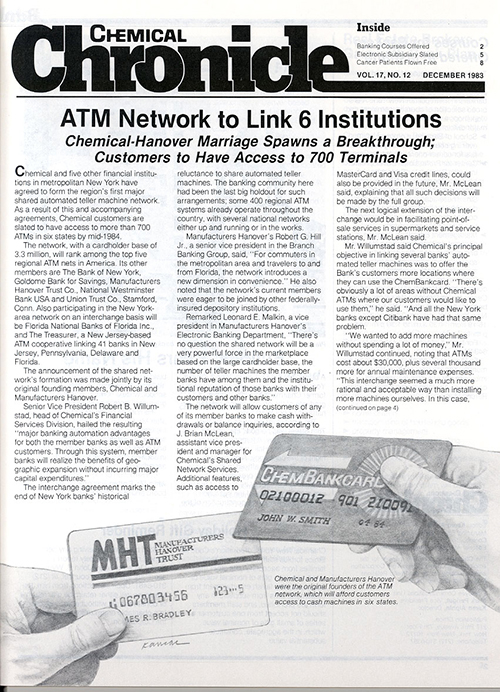

The New York Cash Exchange (NYCE), the first automatic teller network in the New York metropolitan area, gives customers access to more than 800 ATMs in 650 locations in the tri-state area. Chemical and Manufacturers Hanover are among the original founders. Within a year, affiliation with other ATM networks increases NYCE user access to more than 18,000 ATMs across the U.S.

1989

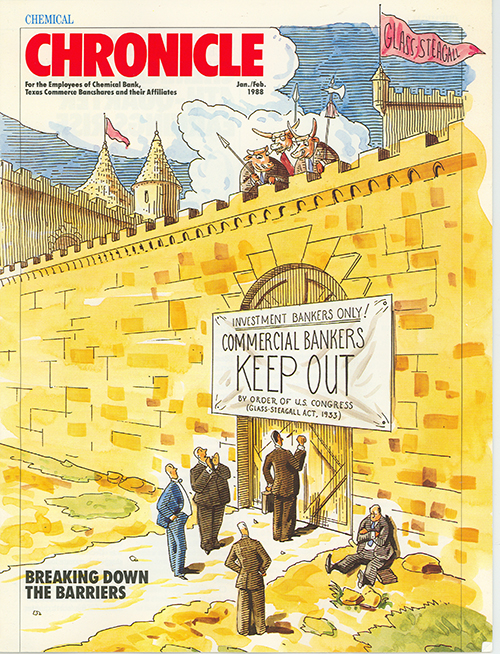

Reversing Glass-Steagall

In a relaxation of the Glass-Steagall banking laws separating commercial and investment bank activities, the U.S. Federal Reserve grants J.P. Morgan & Co. the right to underwrite and deal in corporate debt securities. One year later Morgan is granted equity underwriting powers, becoming the first U.S. bank holding company to provide clients with a full range of securities services since the 1930s.

1991

Chemical and Manufacturers Hanover merge

Chemical Banking Corporation merges with Manufacturers Hanover Corporation, reported in the press as a "merger of equals." The new firm is named Chemical Banking Corporation and is the second-largest banking institution in the U.S. behind Citicorp.

1995

First Chicago merges with NBD

First Chicago Corporation merges with NBD Bancorp. The new firm, First Chicago NBD, is the largest banking company in the Midwest and the seventh largest bank holding company in the U.S.

1995

Online Banking and the Internet

Chemical launches Online Banking which allows customers to consolidate all of their accounts and access them from their home computers. Two years later, NBD Bank, Bank One and Chase each introduce online banking services. First Chicago NBD introduces a free Internet bank in 1998.

1996

Chase Manhattan merges with Chemical

Chase Manhattan Corporation merges into Chemical Banking Corporation in one of the largest consolidations in U.S. banking history. At the time it is the largest bank holding company in the United States.

1998

Banc One merges with First Chicago NBD

Banc One Corporation merges with First Chicago NBD. The new firm, retaining the name Bank One Corporation, chooses Chicago as its headquarters and becomes the fourth largest bank in the U.S. and the world's largest Visa credit card issuer.

1998

J.P. Morgan serves as advisor in Exxon-Mobil merger

As exclusive advisor to Exxon in its merger with Mobil, J.P. Morgan helps create the world’s third largest quoted company and its largest energy company.

The Rise of JPMorgan Chase & Co.

2000

J.P. Morgan merges with Chase Manhattan

J.P. Morgan & Co. Incorporated merges with The Chase Manhattan Corporation. The new firm is named J.P. Morgan Chase & Co.

2004

J.P. Morgan Chase merges with Bank One

J.P. Morgan Chase & Co. merges with Bank One Corporation. The new firm, with its corporate headquarters based in New York and its retail division based in Chicago, retains the name JPMorgan Chase & Co.

2007

Going Green

Chase opens its first environmentally friendly branch in Denver.

2008

JPMorgan Chase & Co. acquires Bear Stearns and Washington Mutual

Collapse of the housing and mortgage markets leads to a severe worldwide financial crisis, the worst since the Great Depression of the 1930s. JPMorgan Chase helps stabilize the markets by acquiring the failing investment firm Bear Stearns Companies Inc. and Seattle-based savings and loan company, Washington Mutual.

2010

J.P. Morgan Cazenove

J.P. Morgan acquires full ownership of the firm's U.K. joint venture, J.P. Morgan Cazenove, with origins dating to 1823.

2010

Mobile Banking

Chase rolls out innovative mobile banking features to help customers manage their accounts, pay bills and transfer money on mobile phones and tablets.

2010

Financing a new GM

J.P. Morgan leads General Motors in its historic initial public offering (IPO), serving as joint bookrunner and co-representative of the underwriters in the $23.1 billion sale, the world’s largest IPO at the time.

2011

Support for Veterans

JPMorgan Chase & Co. joins the 100,000 Jobs Mission, which brings together companies committed to hiring U.S. military veterans and military spouses.

2013

Women on the Move

The firm launches its Women on the Move initiative designed to help women at all levels in the company overcome challenges they face in the workplace and grow their careers.

2013

New Skills at Work

JPMorgan Chase launches a five-year, $250-million initiative to help people build in-demand work skills, adapt and succeed in an ever changing world of work. Building on its original investment, the firm expands the program in 2018 with a new five-year $350-million commitment.

2014

Financing Detroit

JPMorgan Chase & Co. pledges $100 million over five years to support, accelerate and scale some of the most innovative efforts underway to transform Detroit’s economy.

2015

Chase Pay, express checkout

Chase announces Chase Pay, a better payment experience for in-store, in-app and online purchases.

2016

New Skills for Youth

JPMorgan Chase announces a $75 million global initiative to address the economic opportunity crisis facing young people. The initiative, called New Skills for Youth, aims to provide young adults with skills to help them in their job searches.

2018

A new HQ

JPMorgan Chase announces plans to replace its headquarters building at 270 Park Avenue with a new resource efficient skyscraper. The new world-class office tower, will house all NYC midtown employees.

2018

AdvancingCities launches

AdvancingCities is a $500 million, five-year initiative to invest in solutions that bolster the long-term viability of the world's cities and communities that have not benefited from economic growth.

2019

Advancing Black Pathways

Advancing Black Pathways combines JPMorgan Chase's business and philanthropic resources to focus on wealth, education, and careers to accelerate economic opportunities for black people.

[gentle guitar melody]

Rachel: You might be surprised to find out that JPMorgan Chase began by supplying water to Lower Manhattan. By the end of the 18th century, there were close to 60,000 people living in New York City. Most New Yorkers had no easy access to clean water. Unsanitary conditions prompted concern about the spread of disease. But it wasn't until an outbreak of yellow fever reached its peak in 1798, that a group of people decided to take action. And the two men who led the charge were none other than Alexander Hamilton and Aaron Burr. In 1799, Hamilton and Burr presented a charter for the governor's signature that would provide clean water to New York City residents through a private company, the Manhattan Company. But there was a catch. Burr had added a clause into the charter that would allow the directors of the Manhattan Company to start a bank with excess capital not needed by the water company. The charter, with its unusual clause, was successfully passed. In order to transport water through the growing city, six miles of wooden pipes were laid in just the first year, providing clean water to 400 homes, shops, and businesses. This service continued until 1842 when New York City established its own municipal water system, and the Manhattan Company's Waterworks closed its operations. Though the Manhattan Company moved out of the water business, it remained a household name. Remember the clause that Aaron Burr included in the original charter in 1799? Within just six months of securing the charter for the water company, the directors voted to open a bank with their excess capital. And the Bank of the Manhattan Company was born. The Manhattan Company's groundbreaking charter became a template for the establishment of other banks within New York. In 1955, the Bank of the Manhattan Company merged with Chase National Bank, the third largest in the United States, to form Chase Manhattan Bank. And in 2000, Chase Manhattan merged with JPMorgan & Co, to form today's JPMorgan Chase.

[gentle guitar melody]

Elizabeth: With a rich history tracing back over 200 years, JPMorgan Chase has preserved a unique collection of artifacts and records that help tell the story of our firm. In our collection are two legendary pistols that changed the course of history. How did these artifacts impact a young nation and forever change the lives of two famous statesmen and how did they come to be part of our collection? These pistols, made in 1797 are linked to Alexander Hamilton and Aaron Burr. Hamilton and Burr were highly accomplished men who contributed much to the early growth of the United States. Hamilton was a Founding Father and Secretary of the Treasury. Burr was a Revolutionary War hero and Vice President of the United States. They were both lawyers, traveled in the same circles and were both instrumental in founding JPMorgan Chase's earliest predecessor, the Manhattan Company in 1799. But working together was the exception. Hamilton and Burr's personal and political differences fueled an animosity that played out in public as early as the 1790s. Aaron Burr ran for president in 1800. He tied with Thomas Jefferson but lost the re-vote, thanks in part to Hamilton, who had been campaigning heavily against him. Hamilton: "As for Burr, there was nothing in his favor. He is bankrupt beyond redemption except by the plunder of his country. His public principles have no other spring or aim than his own aggrandizement." Elizabeth: As was the law back then, Burr was instead appointed vice president, a concession he wasn't happy about. Four years later, he ran for New York governor, but lost. He learned afterward that Hamilton had again been slandering him. A scorned Burr did what men of distinction often did back then; he challenged Hamilton to a duel. Burr: "You have invited the course I am about to pursue and now by your silence impose it upon me. Elizabeth: Hard to imagine now, but in early America, the practice of a duel, or prearranged fight, was a respected means of settling a score. There were even rules and guidelines about what could and could not transpire. The goal was to defend what the law would not defend, a man's honor. On July 11, 1804, Hamilton and Burr met in Weehawken, New Jersey. Hamilton carried with him a set of pistols owned by his brother-in-law John Church. As the challenged man, it was his right to select the guns. Hamilton fired his shot in the air. Burr aimed directly at Hamilton and mortally wounded him. The two men returned by boat to New York City where Hamilton died the following morning. Burr, the Vice President was indicted for murder in both states. The charges were dropped, but his political career was destroyed. The pistols survived and in 1930, the Bank of the Manhattan Company, JPMorgan Chase's earliest predecessor, purchased them from the Church family. Years later, in the 1970s, long hidden details were revealed. Both pistols were equipped with a hidden mechanism called a hair trigger, which, if engaged, would allow its user to fire faster than normal. Hamilton, who procured the pistols, would have likely known about this feature and it could have given him an advantage. So, how did he lose? We'll never know for sure, but we're proud to preserve these two pieces of American history and explore their role in a pivotal moment in time.

[laid back acoustic music]

Virginia: From New York to Mumbai to Tokyo, JPMorgan Chase's footprints spans worldwide. Famed American banker, J. Pierpont Morgan, is the namesake and one of the founders of our firm. But it was his father, Junius's, move to London that first put the Morgan name on the international map and created a special relationship between the firm and the city of London that continues today.

The story begins in the 1850's. Junius Morgan was a successful New England merchant, but he was ready for something bigger. London was calling. London, at the time, was the capital of the vastly wealthy British empire and the epicenter of international finance. In 1854, Junius accepted an invitation to join American banker, George Peabody, in London. Junius eventually took over Peabody's firm which he renamed J.S. Morgan & Company. It oversaw several landmark transactions and became the most prominent American-owned merchant bank in London. The firm raised capital for the first transatlantic cable project in 1858, revolutionizing communications between Europe and the United States. Sending a message could take 10 days -- the time it took to physically post a letter by ship. With cable, it was a matter of minutes. This and later communication advancements would allow people on both sides of the Atlantic to share accurate information about the availability and pricing of goods. In time, trade flourished, money flowed, and banks gained ever greater importance.

In 1870, J.S. Morgan & Company arranged a much needed 10 million pound loan to the French government during the Franco-Prussian war. Few other banks were willing to take the financial risk, but France repaid ahead of schedule. This propelled J.S. Morgan further up the ranks of international finance and greatly enhanced its reputation in London and beyond. Around the same time, London-based Junius introduced his son, J. Pierpont Morgan, to Philadelphia banker, Anthony Drexel. Together, they founded the wildly successful New York-based private bank, Drexel, Morgan & Company, which Pierpont later renamed J.P.Morgan. Though they operated separate firms, Junius and Pierpont worked in tandem between New York and London building a special transatlantic relationship between the two cities. Raising money in both the United States and Europe, their combined efforts helped finance a number of international industries. Most notably, the American railroad. As track after track was laid and dollar after dollar made, the Morgan name gained even more prominence internationally. After Pierpont's death in 1913, his son, Jack, took over J.P.Morgan just before the start of World War I. It was Jack who provided a $500 million loan in 1915 to American allies, Britain and France -- the largest at the time in Wall Street history. Jack received personal letters of thanks from the prime minister and King of England for his efforts. Prime Minister: I wish to express, on behalf of His Majesty's government, our warmest and most sincere thanks for the invaluable assistance you have rendered to this country during the war. Virginia: The British connections were more than just business. Jack developed a warm relationship with the royal family, hosting them aboard his yacht and at his lodge in Scotland every summer. Throughout the 20th century, the firm's ties to London deepened as it became more physically present in the city. In 1959, J.P.Morgan & Co merged with the Guaranteed Trust Company of New York, the oldest U.S. bank in London. This expanded the bank's presence throughout the city. In 2010, the firm acquired the successful British investment bank, Cazenove. Soon after, it chose London as its European headquarters opening in England's financial center, Canary Wharf. For over 150 years, London has, and will continue to be, a city at the core of the JPMorgan Chase identity.

(gentle guitar music)

Rachel: From colonial America to the pioneer West, paper currency fueled the growth of the nation. Everything from building cities and towns to facilitating the exchange of goods and services depended on an accepted means of payment. But you might be surprised to learn that the US government didn't issue money in the early 1800s. Instead banks printed their own bank notes. Many banks worked with specialized firms, like the American Bank Note Company, to assist in the design and printing of these notes. The notes were exceptionally beautiful, with elaborate ornamentation depicting portraits of public figures, scenes from everyday life, and allegorical images. With little government regulation and no standard template, the size, shape, and color of bank notes varied widely. Every note was a work of five or more artists, each a specialist in portraiture, landscapes, lettering, or borders. Such division of labor was a form of security to hinder counterfeiting. The designs were engraved on metal plates, a process which could take an artist several months to complete. Notes were printed on hand-operated presses, creating four notes from a single printing plate. Sometimes, single note plates were made, like those for our predecessor, the Waterbury Bank. As America's market economy extended nationwide, bank notes began drifting farther from their issuing institutions. With more than 1,500 banks in operation by 1860, and more than 7,000 different notes in circulation, counterfeiting had become a serious problem. The resulting chaos was a paradise for counterfeiters, like Jim the Penman, who became one of the most notorious forgers in the country. To combat this, counterfeit detectors were published which included signatures from authentic bank notes to help bankers identify fraudulent bills. They were hugely popular and boasted a circulation of more than 100,000 by 1855. As the ability to judge the veracity of bank notes deteriorated, the US government recognized the need for a more stable form of currency. In 1862, the federal government began printing its own paper money, marking an historic shift in the young nation's monetary system.

[gentle guitar music]

Nancy: Did you know that the US dollar didn't always look the way it does today? American banks used to print their own paper money. And because there was no standard template, the look of these notes varied widely from bank to bank. With 1,500 banks, including many JPMorgan Chase predecessors issuing their own money, the system was chaotic and in need of change. In 1862, to address this situation and also to finance the Civil War, Salmon P. Chase, the US Secretary of the Treasury and one of our firm's namesakes, helped to create the Legal Tender Act. This gave the US government the ability to establish a uniform national currency. Unlike the notes still printed by banks, the government printed their bills on both sides using green ink on the back to prevent counterfeits. These notes were nicknamed greenbacks and became the primary currency of the Union. Salmon Chase even had his image on the first series of $1 greenbacks printed in 1862. And JPMorgan Chase owns the very first bill of that series. Unfortunately, these greenbacks didn't solve the country's currency problem because they were backed only by government credit and banks continued to issue their own notes, backed by gold and silver. To improve the system and standardize the look and feel of bank notes, a uniform template was adopted and the Bureau of Engraving and Printing in Washington DC took over the job of printing all notes issued by banks. Proofreaders, generally women, were hired to examine the notes for inconsistencies. It took until the 1930s to fully replace bank notes with Federal Reserve notes, the national currency in use today.

[gently guitar instrumental]

Nancy: Did you know that the core values and business principles of JPMorgan Chase today were established over 150 years ago by three generations of Morgan men? The story begins with Junius Morgan, a New England businessman who established the Morgan name in the world's financial markets while working as a merchant banker in London in the 1800s. With Junius' guidance, his son, J. Pierpont Morgan, entered the banking business. In 1871, Pierpont joined forces with Anthony Drexel, a prominent Philadelphia-based banker, and established a new merchant bank in New York City. The Drexel-Morgan partnership initially operated as an American agent for Junius' European firm. It didn't take long, though, for it to become the preeminent private bank in the US. Under Pierpont's leadership the firm, later renamed J.P. Morgan and Company, was largely responsible for financing and organizing the railroads, steel, and utility companies that established the United States as a modern industrial power. Pierpont also played a critical role in times of financial crises, stemming international panics in both 1893 and 1907. He became known for his integrity and judgment, the same standards by which he measured his colleagues and clients. In a statement to the Senate Banking Committee in 1912, Pierpont noted that, 'the first thing is character,' before money or anything else'. After Pierpont's death in 1913, his son, J.P. Morgan Jr, better known as Jack, took over as senior partner of the firm. Jack left his own mark on J.P.Morgan through a series of landmark deals, leading the firm for three decades. Like his father, Jack embodied the same values of honesty and integrity, stating that, 'the idea of doing only first class business, and that in a first class way, has been before our minds.' And this concept is the way we do business today. In 1940, J.P.Morgan reorganized from a private partnership to a public company, with Jack as its first chairman. Over the next 60 years, the firm remained an innovative leader in the financial industry, and in 2000, merged with Chase Manhattan to form JPMorgan Chase.

(gentle guitar melody)

Nancy: What was J. Pierpont Morgan's role in stopping the Panic of 1907 and how did it shape the US economy? In the fall of 1907, the world is on the verge of economic collapse. US and international markets had been wildly unsettled for months. Six months earlier, the American stock market had crashed despite record corporate earnings. And stocks also plummeted on several foreign exchanges. When stock prices plunged again in the summer, the estimated loss was $1 billion. Surprising as it may seem, the US had no central bank to deal with the financial crisis and no money in reserve. As panic increased, customers rushed to their banks to withdraw whatever money remained. People sat overnight in camp chairs, bringing food and waiting for the banks to open in the morning. Some even earned up to $10 a day holding places in line. Banks took unconventional measures to deal with the crisis. Tellers slowly counted out money to limit withdrawals, and some banks prominently displayed piles of cash in order to reassure worried customers. To stem the panic, it was critical that someone with influence and insight come to the rescue. And the person who stepped in, was J. Pierpont Morgan. At the time, Morgan's firm, JPMorgan & Company, was the country's preeminent private bank. More importantly, Morgan had experience with similar financial crises, having rescued the US Treasury during the Panic of 1893. He'd become the lender of last resort. So in October 1907, the semi-retired Morgan called together New York's leading bankers to his library on East 36th Street in Midtown Manhattan. For two weeks, he led a team raising capital for the failing markets, contributing large sums of his own money, and functioning as the country's de facto central bank. Although the actual panic lasted only a few weeks, its aftermath brought on an economic decline that destroyed banks and other businesses and created mass unemployment. Financial experts consider Morgan's impressive handling of the panic as the work of a bold financier who clearly understood the big picture and took decisive action. In 1908, Congress passed a currency act allowing banks to form reserve associations that could issue money temporarily, in economic emergencies. And in 1913, shortly after Morgan's death, the US established its much-needed central bank, the Federal Reserve.

[gentle acoustic music]

Elizabeth: 1914 saw the start of a war like no one had ever seen before. Sparked by the assassination of Archduke Franz Ferdinand of Austria-Hungary, World War I tore nation after nation apart. It was unprecedented in scale. It demanded vast numbers of people and resources and was incredibly expensive. It was known as a total war because it affected every facet of society, including banking. How did a series of bold moves by banks and their employees help the Allied cause? In 1915, U.S. allies Britain and France were in dire financial straits. To help them, JPMorgan & Co arranged a much-needed $500 million loan to the two nations. At the time, it was the largest foreign loan in Wall Street history. The firm also acted as a purchasing agent for the Allies, helping to secure almost $3 billion worth of desperately needed munitions and raw materials. As fighting waged across continents, tensions in the Unites States were mounting. After nearly three years of declared neutrality, in April 1917, U.S. Congress declared war.

[patriotic music and cheers]

Singer: § Over there, over there... §

Elizabeth: The transition was swift and JPMorgan Chase predecessor banks were quick to respond at home and overseas. Banks organized Liberty Loan drives imploring patriotic citizens to lend money to the government for the war effort. These war bonds gave many Americans their first taste of investing in financial securities. Many bank executives also stepped in to lead various wartime committees like the Red Cross and the Council of National Defense. Banks were equally supportive on the front lines.

Guaranty Trust Company raised money for an ambulance and sent an armored mobile bank to service soldiers in France. Thousands of bank employees enlisted to fight in the war and sent home dramatic tales from the field that made their way into bank newsletters.

Soldier: "Our battalion has had two gas attacks and several Boche raids."

Soldier 2: "We saw shrapnel from the defense guns. It was bursting high in the air."

Soldier 3: "The mines upset and ruined the tanks. It was a masterly defense, one of the best military feats of the war."

Elizabeth: Women stepped in to fill vacant jobs as tellers, clerks and loan officers. In addition to their bank duties, these women were instrumental in fundraising and relief work. Partnering with the Red Cross, they knitted socks and sweaters and packaged surgical dressings for soldiers overseas. In November 1918, World War I came to an end. Many JPMorgan Chase predecessor banks advocated for the rehiring of veterans and erected memorials to honor bank employees who had given their lives for their country. Though international banking played an unprecedented role during the war, it was the banks' dedicated men and women, working at home and fighting overseas, who battled tyranny and enabled democracy to prevail for all.

[gentle acoustic music]

[END]

[gentle guitar melody]

Rachel: The blue octagon is an iconic and recognizable logo that's become synonymous with the Chase retail brand today. But did you know that its creation sparked a new movement in the design of corporate logos? In fact, when the octagon was first launched it represented a benchmark in corporate culture showing how firms were beginning to understand the significance of a strong brand and how they were perceived in what was already a fast paced world. But what prompted the bank to reassess its logo back in 1959? Shortly after the 1955 merger that created the Chase Manhattan Bank, then Vice Chairman, David Rockefeller, chose the design firm Chermayeff and Geismar Associates, to create a logo that would best reflect Chase Manhattan's increasing global reach and complement the modern design of the company's brand new 60 story headquarters in Lower Manhattan. The previous logo failed to capture the unique feel of the brand. Its complex design used five different elements from the company's two main heritage banks, the Bank of the Manhattan Company and Chase National Bank. Rockefeller knew the logo needed a strong graphic, something recognizable around the world. Inspired by a simple geometric shape the design firm hired by Rockefeller created the octagon logo, a visual that was sleek, attractive and timeless. On November 21st, 1960, the new logo was unveiled, one of the first abstract logos used in banking. With its clean lines and modern look the dynamic symbol mapped against Chase Manhattan's corporate vision demonstrating, as the designers put it, how all activity is centered around a square, implying growth from a central foundation. Just like any business, Chase and its logo have gone through subtle changes over the years. Although the original design featured multiple colors and patterns, in 2004 the solid blue octagon was adopted. While variations in the color and typeface have evolved over the years, the strength of the octagon remains the enduring symbol of the Chase brand.

[pleasant acoustic music]

Steven: As early as 1799, JPMorgan Chase's predecessor banks used advertising to tell the public about their banking services and attract new customers. In the 200 years since our firm was founded, banks have relied on this powerful tool to bring in new business. Early advertisements took the form of newspaper notices and text-heavy magazine ads. But that changed during the 1950s and '60s, a heyday of bank advertising that reached out with more creative content to a broader demographic of potential customers. The ad industry was coming of age and JPMorgan Chase's predecessor banks used the best in the business to craft attention-grabbing promotional campaigns. In print, radio, and TV, the banks advertising agencies worked hard to change consumers' perceptions of our banks, turning them from impersonal institutions to customer-friendly financial firms, providing services to make their lives easier and better. During this time, Chase Manhattan Bank unveiled its playful 'Nest Egg' campaign. The ads featured people trying to relax or have fun while shackled to giant eggs. Then there were the 'You Have a Friend at Chase Manhattan' ads, which sought to personalize the banking experience globally. This iconic campaign launched in 1960 and ran for over 15 years. Whether making a deposit in Malaysia, or wiring money from Mexico, the message around the world was that no matter where you are, Chase is there for you. In contrast to Chase's global focus, Chemical Bank targeted a more specific audience. TV ad spokesperson: The New York woman. When her needs are financial, her reaction is chemical. Chemical New York. Steven: This 1965 campaign was one of the first in the industry to market directly to women. It was right on trend as the decade saw women entering the workforce in greater numbers and gaining more economic power. With the standard of living on the rise, the 1960s also saw a boom in car sales and with that, auto focused ad campaigns. The Manufacturer's Hanover Auto Loan Department made its mark with its unusual 'Sponge on Wheels' advertisements. The bank reminded customers that, like a sponge, their old, unreliable cars soaked up money in the form of frequent repairs and gasoline. But a Manufacturer's Hanover auto loan could put them into a new, more efficient car and help them save money. The campaign was a success, bringing in thousands of new loans for the bank. In 1971, the same department unveiled its head turning 'Any Car' campaign, showcasing a vehicle created from the parts of 22 different cars. It was the focal point of an aggressive auto loan program. The message? That the bank provided loans for any car, new or used. This amusing campaign featured these quirky composite cars and print, TV and radio ads and parked them in branches for customers to marvel at. During this mid-century Golden Age of Advertising, each of these banks used clever language and creative imagery to capture the spirit of the time and effectively communicate why it was a great idea to bank with us.

(gentle acoustic music)

Steven: Technology has revolutionized how bankers and consumers handle money in amounts ranging from the single penny to billions of dollars. Early banks, including those that would become part of JPMorgan Chase, added up dollars and cents by hand, a time consuming task that left a lot of room for error. Over the years, JPMorgan Chase and its predecessors pioneered technologies that saved money and dramatically increased the speed at which bank work could be accomplished. Around the turn of the 20th century, even simple advances improved the employee and customer experience. The hand cranked adding machine of the 1890s did the work of two people. The direct dial phone eliminated the need for a switchboard, while the electric coin counting machine tallied with accuracy and was up to five times faster than counting by hand. In the 1920s, check processing, the backbone of personal banking, was greatly improved with the Recordak. Bank employees used the machine to process large volumes of checks entering the bank by photographing them, saving hours of work a day, and guarding against forgery. But it was the introduction of the electronic computer in the 1950s that revolutionized banking, propelling the industry forward at an unprecedented pace. Computers quickly became a staple in back offices across the country, and many of our predecessor banks built entire data processing centers devoted to the new technology. In 1959, Chase Manhattan Bank installed an IBM 650 computer, which enabled the staff to process transactions at lightning speed. A few years later, Chase Manhattan opened its New York Automated Check Processing Center, one of the largest in the world. Relying on new computer technology, employees processed checks using a high speed sorter that could read magnetic ink characters. Within the first year, it was processing over a million checks per day. As computerization spread across the country, so too did the bank credit card, which transformed America's shopping habits. Now, instead of opening individual charge accounts with each store, bank clients could use one card for their purchases at any store. In 1969, Chemical Bank unveiled its cash machine, the precursor to the ATM. The ATM, the Automated Teller Machine, made banking on the go possible with the swipe of a card. ATMs appeared in malls, airports and overseas, making it possible to get cash and perform transactions 24 hours a day. The trend for banking whenever, wherever and however you'd like continued. With Bank One's Channel 2000, an early home computer banking program launched in 1980, customers could bank without ever leaving the house. The internet brought banking at home into the 21st century, allowing customers to complete transactions securely online through personal computers, while mobile apps like Chase Pay meant banking could be done with the swipe of a finger on a phone, tablet or watch from anywhere in the world. JPMorgan Chase has come a long way, from bankers computing numbers by hand to a global team of technologists working hard to keep us ahead of the curve. Behind the scenes, the firm is developing new technologies, deploying artificial intelligence and working in the cloud to advance the financial landscape. This culture of innovation is helping employees work smarter, and customers bank better, every day.

[gentle guitar chords]

Virginia: Hi, I'm Virginia, one of the archivists with the JPMorgan Chase Corporate History Program. We are responsible for preserving the history of the firm and its predecessor institutions, over 1200 of them. The firm today is a result of many bank mergers and acquisitions over the years, and is built on the legacy of those predecessor banks. Our valuable collection tells the story of JPMorgan Chase and will preserve our history for future generations to come. Let's take a look around. This is our climate controlled storage facility, a cool enough environment to prevent paper deterioration and mold growth. We collect and preserve everything, from documents to photos, to artifacts and artwork. We use that material to answer questions about the history of the firm and to better understand its business, past and present, around the world. Our department was founded by David Rockefeller, chairman of Chase Manhattan Bank, who understood that a bank's wealth is measured in more than just dollars and cents. From financing the US rail system to pioneering the ATM, our banks were vitally important. These stories can be told through what's found on these shelves and in the exhibits we design in corporate offices around the world. Our collection is constantly growing. In here, we maintain millions of records. That's over three miles of boxes. Items come from branches, employees, and alumni of the firm. We catalog them and integrate them into the larger collection. Elizabeth: Some of my favorite objects are scrapbooks. This one was from the Garfield Safe Deposit Company in New York. It was put together by an employee who was at the bank for over 40 years and he clipped all sorts of things - bank promotional items, forms, envelopes, really anything he thought would help tell the story of this bank's history. Virginia: Photographs are among the most requested items. We have over a million, many of which are stored in these filing cabinets. The images portray everything, from bank interiors and exteriors to employee activities. These drawers over here are filled with advertisements, posters, and oversized photos. Steven: I love this collection of architectural renderings from the Valley National Bank, which was headquartered in Phoenix, Arizona. They're not only wonderful paintings, but they're an interesting view into what commercial bank architecture looked like during the 1950s. In fact, Valley National Bank had the only bank branch in the Grand Canyon. Virginia: These shelves are where things like artwork, artifacts, and ephemera have their own special home. From 19th century coin counters to 20th century teller cages, the artifacts we preserve help us to bring to life all aspects of banking. Rachel: Our firm started not as a bank, but actually as a water company. This is one of the original hollowed out wooden pipes that was used to transport water to the homes and businesses of Lower Manhattan. We've carefully preserved it, and our hope is that'll last for another 200 plus years. Virginia: Our legacy defines us, and it's through these items that we share stories of our firm and its tremendous impact on not just the financial industry, but the world at large.